Why Dental Insurance is Separate (and Why it's Not Really Insurance)

You only think about health insurance once a year. Ideally, you wouldn’t think about it at all. Your employer sends a link to register for benefits. You select a plan, click submit, and move on with your life.

Insurance is complex, boring, and frustrating -- most people don’t have the patience or expertise to thoroughly evaluate their options. But overlooking details can lead to costly surprises, especially when it comes to dental insurance.

Why is Dental Separate from Medical?

While healthcare and dental insurance may be presented to you in the same way - one checkbox after another on your benefits signup form - they actually function very differently. This distinction is confusing and arguably deceptive. In fact, some people correctly point out that dental insurance isn’t actually insurance - it’s a prepaid discount plan.

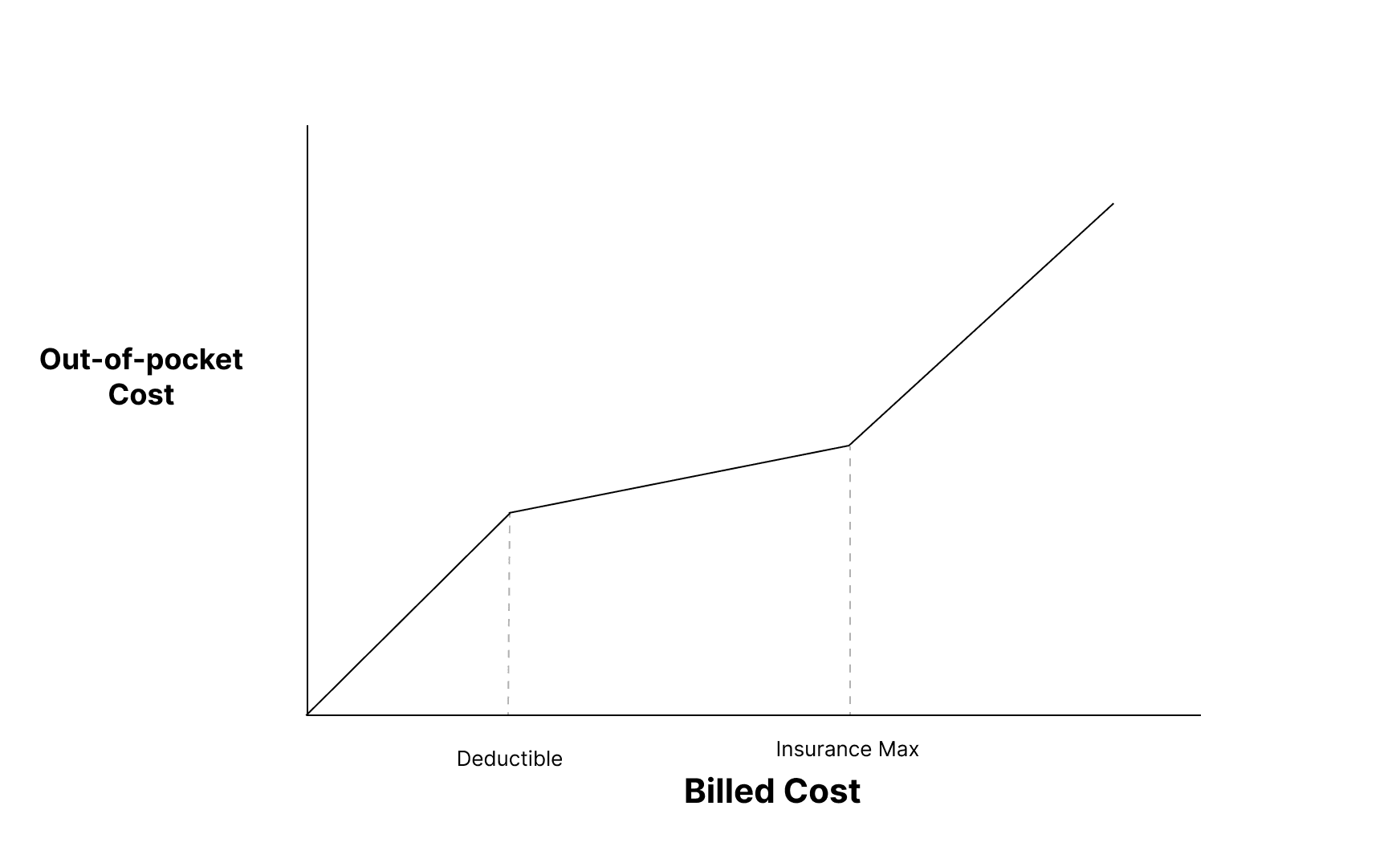

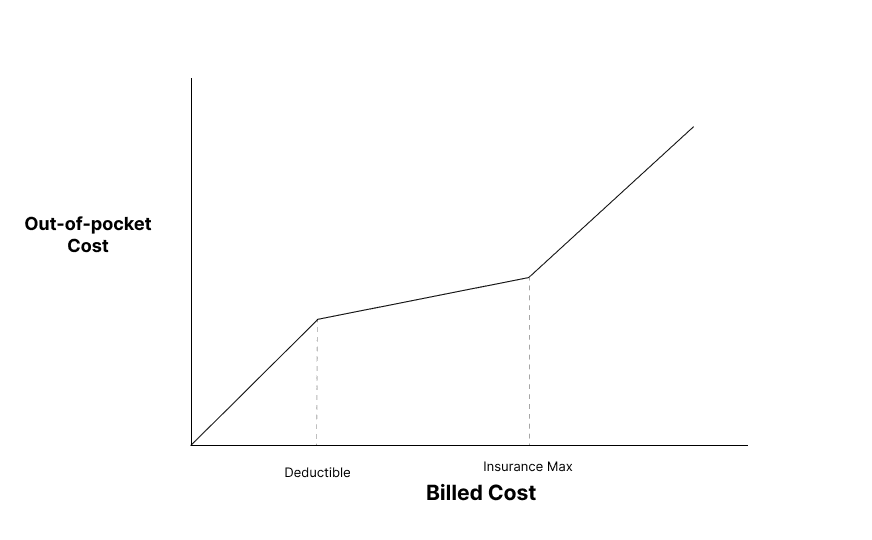

Unlike health insurance, dental insurance doesn’t fully insulate you from large out of pocket costs. Your plan likely has a maximum benefit amount - $1,000 or so - after which you’re on your own. If you get a bill for $5,000, most of the burden falls on you, the patient, and not your insurer. You pay monthly premiums, but those payments mostly count toward routine care and not much else.

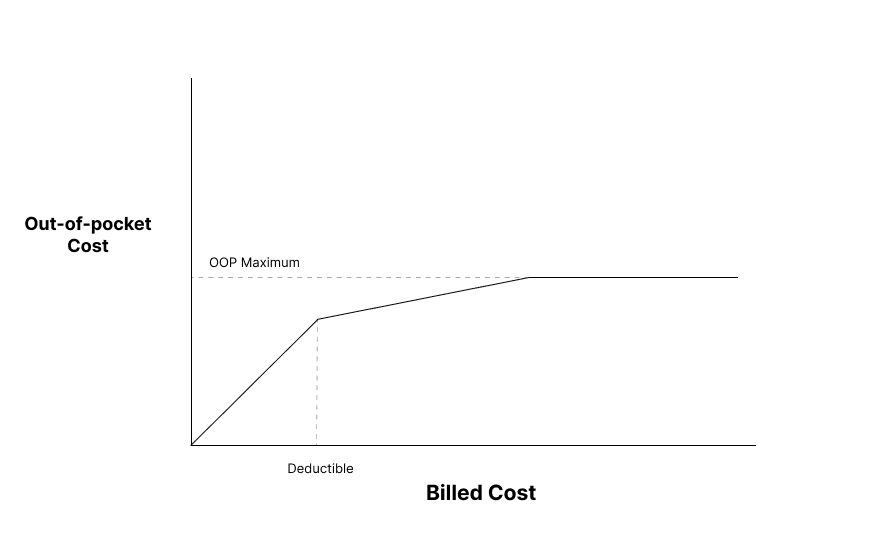

Contrast this to medical insurance, where you actually are limited in your liability. If you get a large medical bill, there is an out-of-pocket maximum, beyond which your insurance company has to pay everything else.

The reasons for this difference are historical, political, and structural, related to the types of care that each insurance product covers - but again, these aren’t details that normal people are expected to know.

Yet the implications of this difference, if you’re evaluating your dental care or dental insurance, are large:

1. You may have purchased dental insurance without understanding if it actually makes sense for you. (We’ll discuss how you can evaluate this decision in a separate post.)

2. You may need expensive dental care (a crown, filling, etc.), only to find yourself with a surprise bill after the fact. Your insurance won’t cover it.

Many people find themselves in this situation - dental problems can happen fast, and there’s no time to calmly evaluate pricing when you’re experiencing the worst pain of your life. Painful enough on its own, the shock of a large, unexpected bill only makes matters worse.

How Slash Dental Can Help

Slash Dental helps you pay fair prices for dental care. We use cutting-edge AI and regulatory know-how to review your bills, identify mistakes or overcharges, and negotiate directly with dentists and insurers on your behalf.

If you’re tired of surprise dental bills or worried about negotiating with providers yourself, let us help.

Get started today or contact info@slashdental.com.